External Forces on Financial Markets: Evidence from the GameStop Short Squeeze and Flash Crash

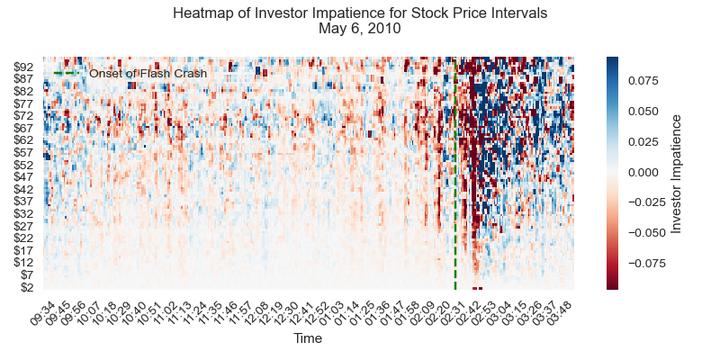

Investor Impatience during the 2010 Flash Crash

Investor Impatience during the 2010 Flash Crash

Abstract

In this research, we present a system of equations for measuring external forces in financial markets. As in physics, we claim that there is a measurable force caused by external market forces, which we call investor impatience and equate with gravitational force. We simulate this force and its accompanying energy conservation equation equation using a physics- based Eulerian fluid flow system. We test this idea by analyzing minute-by-minute data from meme stocks during a one-of-a-kind market event, the January 2021 the GameStop short squeeze. The resultant parameters show that external forces have an effect on stock prices. The investor impatience parameter is shown to improve out-of-sample forecasting of investor sentiment, estimated using comments from Reddit’s WallStreetBets forum during the short squeeze. We expand our study to the 2010 flash crash, demonstrating that the system accounts for exogenous influences on market behavior.