Biography

My research interests are in optimization, decision-making under uncertainty, and machine learning with applications to finance, business processes, and energy systems. I am currently working on goal-based wealth management for optimal portfolio allocation and income contributions for investors with retirement accounts, stochastic income, and consumption.

- Optimization

- Computational Finance

- Machine Learning

- Optimal Control

-

Bachelor of Engineering (Honors) in Engineering Science, 2019

University of Auckland, Auckland, New Zealand

-

Master of Dairy Science and Technology, 2020

Massey University, Palmerston North, New Zealand

Experience

Within the Autobidder Algorithms team, I have:

- Developed and implemented algorithms for improved benchmarking of grid-scale battery operations.

- Designed a novel error metric for assessing wholesale energy market forecasts.

- Created performance-measurement visualizations for the operations team.

Within the Commodity Risk & Trading team, I have:

- Conducted portfolio optimization for hedging and risk management for the world’s largest dairy exporter.

- Improved risk estimation and scenario analysis for managing the dairy futures portfolio.

- Reported exposure and risk statistics to the Central Portfolio Management team.

As part of the program, I have:

- Designed and implemented a computer-vision setup for automated mozzarella product grading, applying full-stack Python web development and OpenCV image analysis methods.

- Optimized national employee relocations to enhance placement quality while minimizing business costs.

- Worked in five dairy production sites, each specializing in a different process and product (protein, cheeses, infant formula, and cream products).

Featured Publications

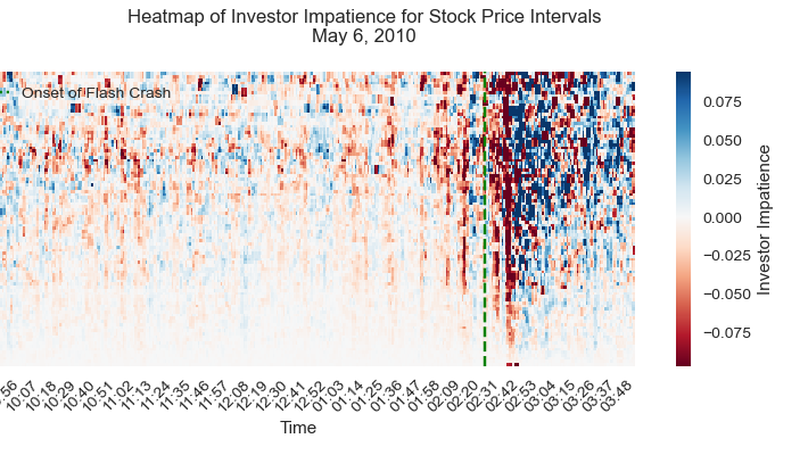

In this research, we present a system of equations for measuring external forces in financial markets. As in physics, we claim that there is a measurable force caused by external market forces, which we call investor impatience and equate with gravitational force. We simulate this force and its accompanying energy conservation equation equation using a physics- based Eulerian fluid flow system. We test this idea by analyzing minute-by-minute data from meme stocks during a one-of-a-kind market event, the January 2021 the GameStop short squeeze. The resultant parameters show that external forces have an effect on stock prices. The investor impatience parameter is shown to improve out-of-sample forecasting of investor sentiment, estimated using comments from Reddit’s WallStreetBets forum during the short squeeze. We expand our study to the 2010 flash crash, demonstrating that the system accounts for exogenous influences on market behavior.